Are you still confused from the commonly used terms “delay” (or “order execution delay”) and “slippage”? In this article we will explain the difference between delay and slippage and how it is related to each other. You will get a better overview of how it affects your trading and how you can avoid it (or better to say how to mitigate it).

Order execution delay

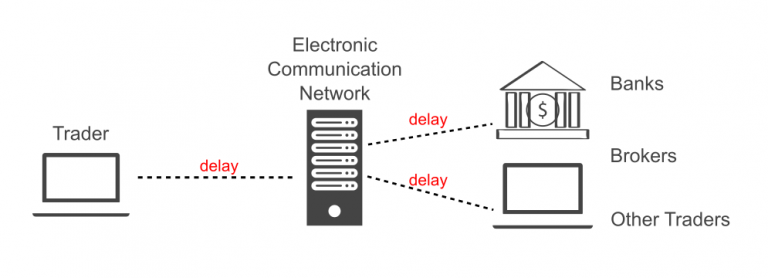

Order execution delay is the delay between your mouse button click for opening the trade and real order execution. There are several things that can affect this. So lets take a closer look.

The first thing that affects the delay is your internet connection and distance of your internet provider to the broker’s server. Better connection you have and closer the broker’s server you are, the lower delay you can get.

Second part is your broker. If you are trading with true ECN broker there is usually very small delay in order execution. If you are trading with Market Makers there can be intentionally created delays to affect your trading. Difference between brokers is explained in other article.

With ECN brokers the biggest part of your delay is caused on your side (internet connection and distance to broker’s server). Usually if you are not using some VPS server we talk about overall delay around 100 – 200 ms. With good VPS server and true ECN broker you can get delay less than 5 ms. If you are trading with Market Maker broker the delay of your internet connection is the same as above but the bigger portion of delay can be caused by the broker.

Slippage

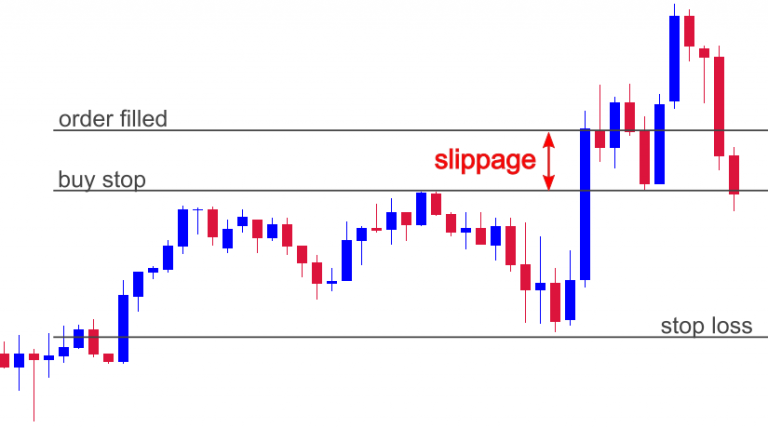

Slippage is caused by the market itself. If you want to buy “something” there must be “someone” who will sell you that “something”. The same rule works on the forex market.

If you want to buy lets say 1 lot of EURUSD there must be someone who will sell you 1 lot of EURUSD. If there is not someone selling at the point where you want to buy it – the slippage occurs. For better explanation lets consider an example with pending order buy stop. With buy stop we will limit the execution delay because the order is already waiting on the market to be filled.

Lets say you place buy stop at the price 1.12500 and stop loss at 1.12000. So your stop loss is 500 points distant. The market price moves fast and crosses your desired level 1.12500. Your order is supposed to be filled at this point but it is not because there is no seller right at this exact spot. Price still moves up and your order is filled at the price 1.12600 – 100 points above your desired level because now there is somebody selling. Bad thing about this is that you just lost 100 points of possible profit and the stop loss is 600 points instead of your originally placed 500 points because the slippage was 100 points.

How to avoid delay and slippage?

You can’t avoid it but you can mitigate its affect. Delay and slippage usually affect your trading in negative way. If you are trading manually and you are placing market orders, at first you may have delay before your order reaches the market. And if there is not sufficient liquidity you can experience some slippage as well. If you use limit orders then delay usually doesn’t affect your trading but the slippage can’t be avoided.

To get lower execution delays you should have very stable and fast internet connection. The best is to have interenet connection very close to the broker’s server.

Regarding the slippage the first rule is to choose reliable broker (ideally true ECN) that can provide you sufficient market liquidity. Second thing you can do to mitigate slippage is to trade instruments that are widely used by the liquidity providers and are not very volatile. Another way is to trade lower lot sizes. There is much higher chance to get order of 1 lot filled faster than order of 10 lots.

Share this:

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Telegram (Opens in new window) Telegram

- Share on WhatsApp (Opens in new window) WhatsApp

It’s a pity you don’t have a donate button! I’d without a doubt donate to this outstanding blog! I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this site with my Facebook group. Chat soon!

You can find donate button on the second part of the website: https://747developments.com/developments (at the bottom of the page).

I was very pleased to search out this net-site.I wanted to thanks on your time for this wonderful learn!! I positively having fun with each little bit of it and I’ve you bookmarked to check out new stuff you blog post.

I was suggested this web site by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You are amazing! Thanks!

Sweet blog! I found it while searching on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thanks

I have no idea, it probably takes some time to get listed. But I didn’t do anything for being listed there.

I like the valuable info you provide in your articles. I抣l bookmark your weblog and check again here regularly. I’m quite sure I抣l learn a lot of new stuff right here! Best of luck for the next!

Comments are closed.